One Big Beautiful Bill

If you are an American Citizen or if you are interested in gaining citizenship to USA, this blog will give you insight on the One Big Beautiful Act that is currently under President Donald Trump Administration. Each President has their own unique plan on what would benefit Americans and families in our country. Some of these laws are created due to the condition of the economy. Let's Talk About One Big Beautiful Bill.

The OBBBA contains hundreds of provisions. It permanently extends the individual tax rates Trump signed into law in 2017, which were set to expire at the end of 2025. It raises the cap on the state and local tax deduction to $40,000 for taxpayers making less than $500,000, with the cap reverting to $10,000 after five years. The OBBBA includes several tax deductions for tips, overtime pay, auto loans, and creates Trump accounts, allowing parents to create tax-deferred accounts for the benefit of their children, all set to expire in 2028. It includes a permanent $200 increase in the child tax credit, a 1% tax on remittances, and a tax hike on investment income from college endowments. It phases out some clean energy tax credits that were included in the Biden-era Inflation Reduction Act, and promotes fossil fuels over renewable energy. It increases a tax credit for advanced semiconductor manufacturing and repeals a tax on silencers.

In 2026, families will have a new way to support their children’s financial futures: the 530A account—better known as a Trump account—a tax-advantaged IRA designed specifically for kids.

A Trump account is a new type of IRA established as part of the One Big Beautiful Bill Act. To open a Trump account, your child must have a Social Security number and be a U.S. citizen under 18 years old on December 31 of the year the account is opened. Each child may have only one Trump account.

529 plan: In 2025, you can put in up to $19,000 for each child. Couples can contribute up to $38,000. You can also "front-load" up to $95,000 in one year for each child. Couples can front-load up to $190,000 without worrying about gift tax.

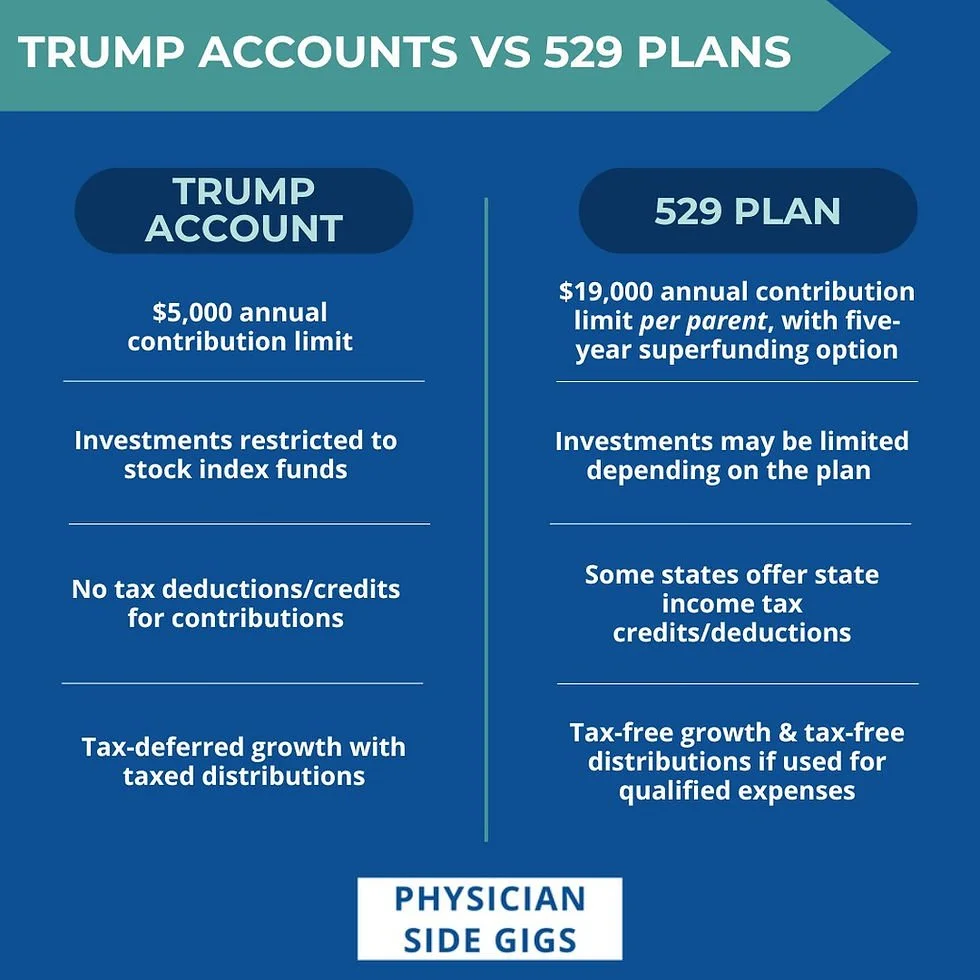

● Trump Account: $5,000 annual cap plus the one-time $1,000 seed.

Investment flexibility:

● 529 plan: Age-based portfolios automatically adjust from stocks to bonds/cash as college approaches.

● Trump Account: Must be in low-cost U.S. equity funds only — less flexibility to adjust risk over time.

Tax treatment:

● 529 plan: Withdrawals are tax-free for qualified education expenses.

● Trump Account: Withdrawals are taxed as ordinary income and may face penalties if used early for non-qualified purposes.

Exrta perks of 529 plans under OBBA:

● Broader use of funds, including K–12 tuition (up to $20,000 annually from 2026), tutoring, credential programs, and licensing exams.

● Ability to roll up to $35,000 of unused funds into a Roth IRA for the beneficiary under certain conditions.

Bottom line: For most families, 529 plans remain the most versatile, tax-friendly education savings tool. Trump Accounts could be a side option — but not a replacement.

The Trump Gold Card is a visa based upon an individual’s ability to provide a substantial benefit to the United States. To apply, an applicant must pay a nonrefundable, $15,000 DHS processing fee. Once an applicant’s processing fee is received, the process for petition approval and visa adjudication will take place on an expedited basis, assuming applicants submit any additional documents or fees in a timely manner. A $1 million gift upon completion of the individual’s vetting is evidence that the individual will substantially benefit the United States. An individual may also need to pay small, additional fees to the U.S. Department of State depending on his or her circumstances.

Effective July 1, 2026, major federal student loan changes, driven by the One Big Beautiful Bill Act (OBBBA), will eliminate Graduate PLUS loans, cap Parent PLUS loans at $20,000 annually ($65,000 lifetime), and introduce a new Repayment Assistance Plan (RAP). Only two repayment plans (standard and RAP) will exist for new borrowers, and total federal borrowing will be capped at $257,500.

Parent PLUS Loans: New caps are implemented at $20,000 per student per year and a $65,000 lifetime limit per student.

Borrowing Limits & Caps: A new total lifetime limit of $257,500 applies to all Direct Subsidized/Unsubsidized loans.

Repayment Plan Changes: The current Income-Driven Repayment (IDR) plans, including SAVE, are being replaced. Only two options will remain for new borrowers: a Standard Repayment Plan and a new income-driven Repayment Assistance Plan (RAP).

Minimum Payments: A minimum payment of at least $10 per month will be required, even for those with demonstrated financial hardship.

Existing Borrowers: Those with loans prior to July 1, 2026, may have up to three years to borrow under previous, more lenient limits.

Enrollment Impact: Loans will be reduced proportionally for students enrolled less than full-time.

These changes aim to reduce overall student debt, simplify repayment, and prevent overborrowing.

Wealth building is a process and it is achievable. You must have a plan or a goal in mind. The foundation involves establishing an emergency fund, managing debt, and diversifying income streams. Budgeting, making the right investments and creating a savings that accompany your short or long term goals is a great way to build your wealth and assets.

Thanks for stopping by. What are your views on the One Big Beautiful Bill? Feel free to share your ideas in the comment section. While you're here check out the other stories on the site. 🫶🏽